property tax assistance program montana

Property Tax Assistance Program PTAP Application for Tax Year 2018 15-6-305 MCA Part I. A new Montana property tax assistance program is designed to help residential property owners whose land value is disproportionately higher than the value of their home.

Ci 121 Montana S Big Property Tax Initiative Explained

250000 market value determined by DOR - 200000 PTAP applies only to the first.

. For more information and to see if you. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. In accordance with Montana Law property taxes that are delinquent are assessed a 2 penalty and interest charges are incurred at the rate of 56 of 1 per month.

GENERAL PROPERTY TAX PROVISIONS. The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering the amount of land that you can. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible.

That funding will help Montanan. You may use this form to apply for the Property Tax Assistance Program PTAP. If you are already approved for the Property Tax Assistance Program you will not need to apply again.

Maximum of 5000 in the form of a grant to prevent property tax foreclosure or remove or prevent creation of other liens HOA COA CLT lease payments etc. Montana Individual Income Tax Resources. To ensure the correct.

September 2 2021 by Montana Department of Revenue. A new Montana property tax assistance program is designed to help residential property owners whose land value is disproportionately higher than the value of their home. The taxpayer must live in their home for at least seven months out of.

What You Should Know About the Montana Property Tax Relief. Unfortunately it can take up to 90 days to issue your refund and we may. The American Rescue Plan Act passed by Congress and signed by the president contains 9961 billion nationwide for a Homeowner Assistance Fund HAF.

4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM 1 The property owner. Latest version of the adopted rule presented in Administrative Rules of Montana. For a single applicant your income needs to be less than 48626 and for heads of household and married applicants your income must be less than 56107.

Property Tax Assistance Programs. 4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. If you are low income a 100 disabled veteran or surviving spouse or had a large increase in your property taxes due to reappraisal you may qualify for tax assistance.

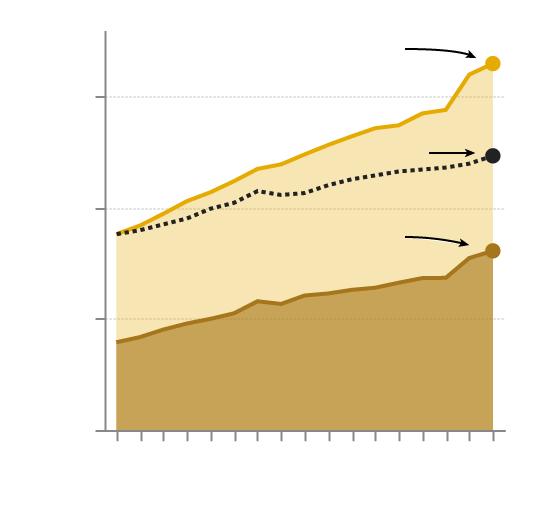

Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax. View or Pay Property Taxes. The property tax calculation for the same property with Property Tax Assistance Program PTAP reduction.

1 The residential real property of a qualified veteran or a qualified veterans spouse is eligible to receive a tax rate reduction. Download or print the 2021 Montana Form PTAP Property Tax Assistance Program PTAP Application for FREE from the Montana Department of Revenue. Tax forms available from Department of Revenue.

Ad 2022 Latest Homeowners Relief Program. You have to meet income and property. Flathead County Treasurer290 A North MainKalispell MT 59901.

Click here to learn about. Check If You Qualify For 3708 StimuIus Check. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Among property owners in Montana the Property Tax Assistance Program PTAP was created to help them repay their debts as a result of their property taxes which. Lien Prevention Program. Extended Property Tax Assistance Program EPTAP affects limited properties that have experienced a greater than 24 increase in taxable valuation due to a reappraisal in 2008.

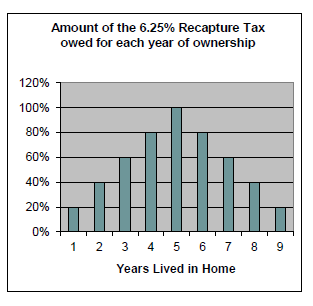

General Information Apply by April 15. 2 The first 200000 in appraisal value of residential real property qualifying for the property tax assistance program is taxed at the rates established by 15-6-134 multiplied by a percentage figure based. To be eligible for the program applicants must meet the requirements of 15-6-302.

Tax Breaks For Montana Property Owners Inspect Montana

Tax Relief Systems Llc Llc Taxes Relief Tax Preparation

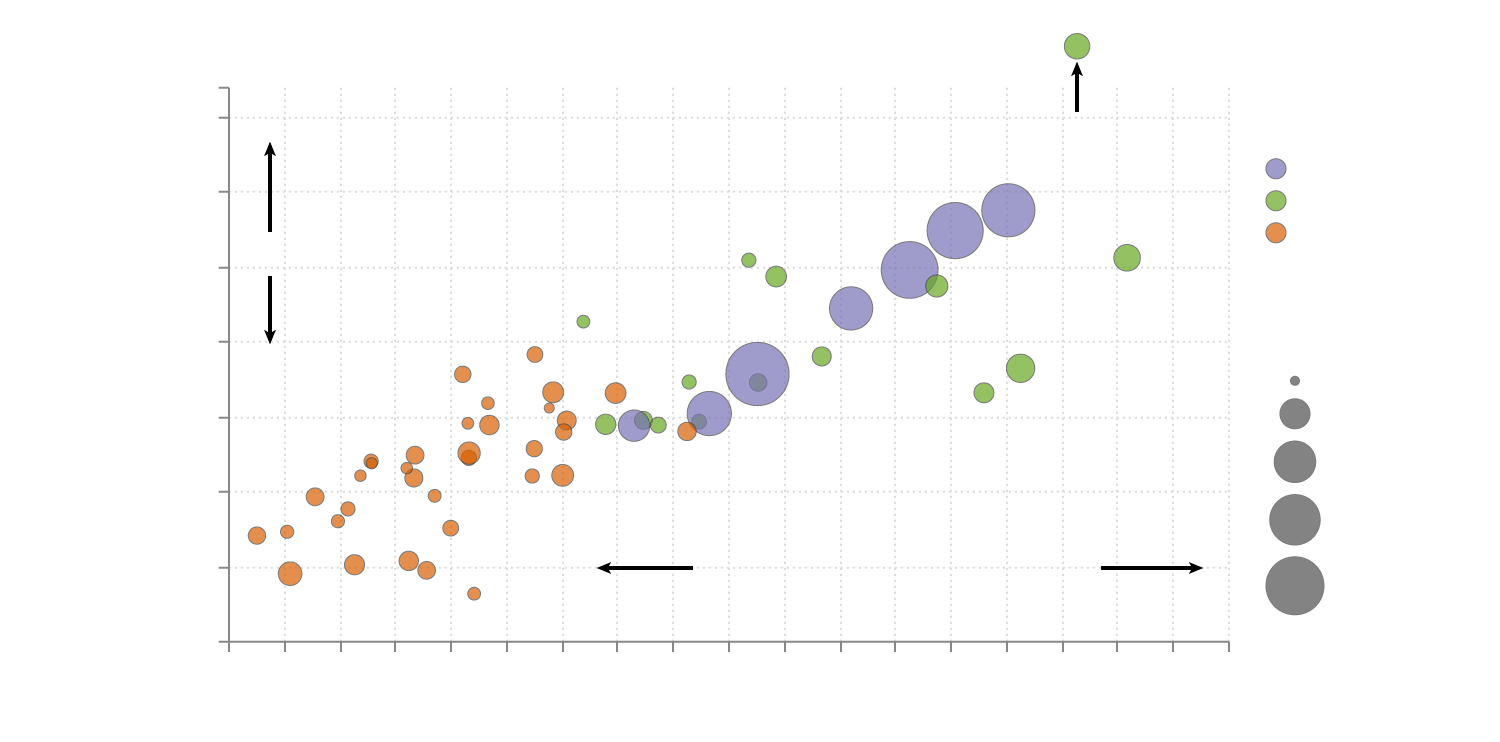

This Graph Is A Statistic Model Of The Crash Of The Stock Market In The 1930 S Over 9 000 Banks Failed Stock Market Stock Charts Online Stock Trading

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Where Are Americans The Happiest Vivid Maps American History Timeline Map America Map

Property Montana Department Of Revenue

Montana Income Tax Information What You Need To Know On Mt Taxes

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Ci 121 Montana S Big Property Tax Initiative Explained

Tax Breaks For Montana Property Owners Inspect Montana

Tax Relief Programs Montana Department Of Revenue

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

Icymi Campaign Posters Opposing 2 Cent Fuel Tax Prompt Complaint To Montana Cop Campaign Posters Gas Tax Campaign

This Chart Explains Saving And Investing In The Simplest Way We Ve Seen Investing Money Where To Invest Managing Your Money

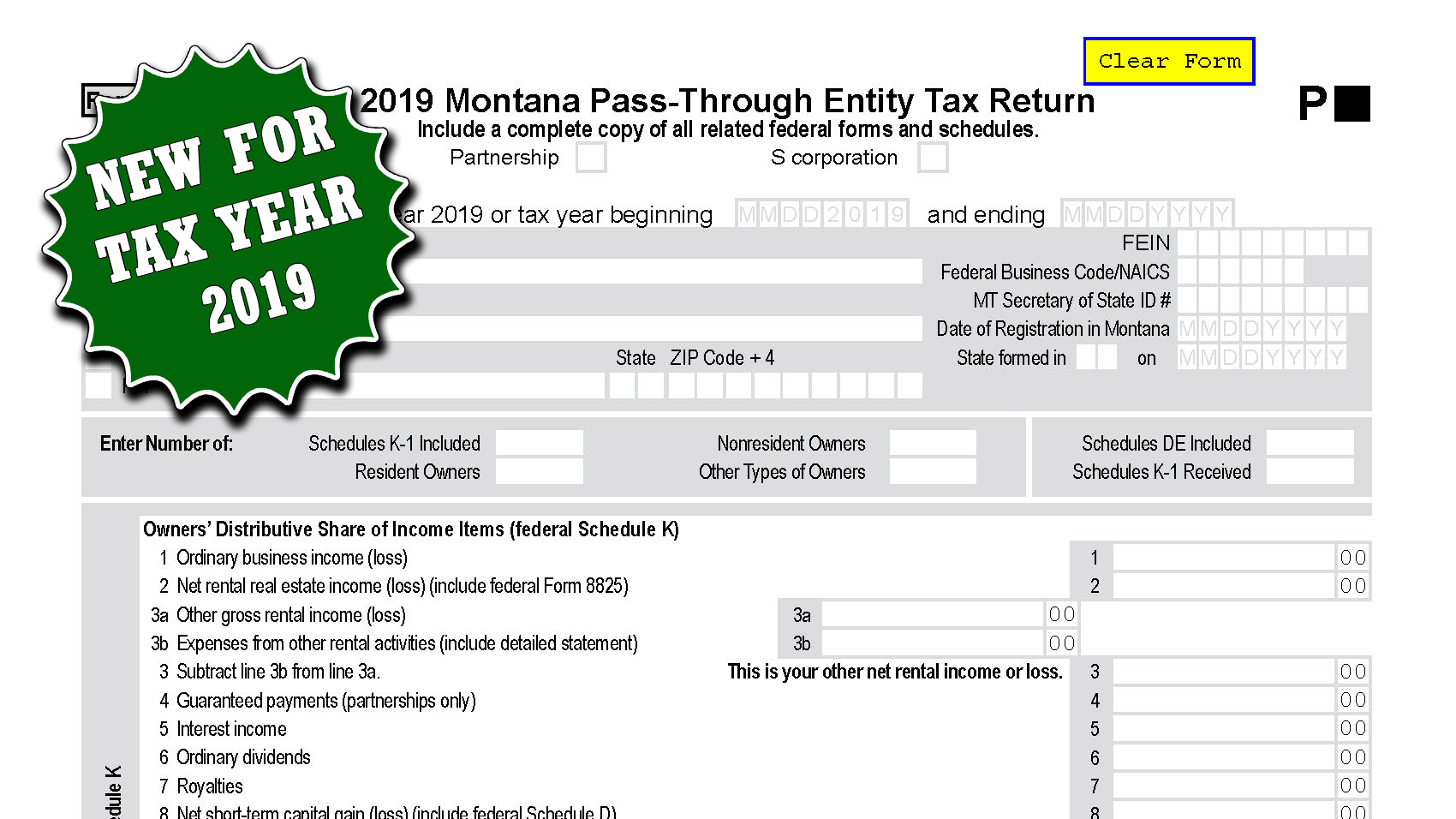

New For Tax Year 2019 Montana Pass Through Entity Tax Return Form Pte Montana Department Of Revenue

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Mortgage Interest Rates